Global Vietnam Express Delivery Service Market Size, Share, Growth Analysis Report - Forecast 2034

Vietnam Express Delivery Service Market By Application (B2B, B2C), By End Use (E-commerce Platform, Social Media Platform, Document Service, Others), By Destination (Domestics, International), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.36 Billion | USD 10.65 Billion | 22.86% | 2024 |

Vietnam Express Delivery Service Industry Perspective

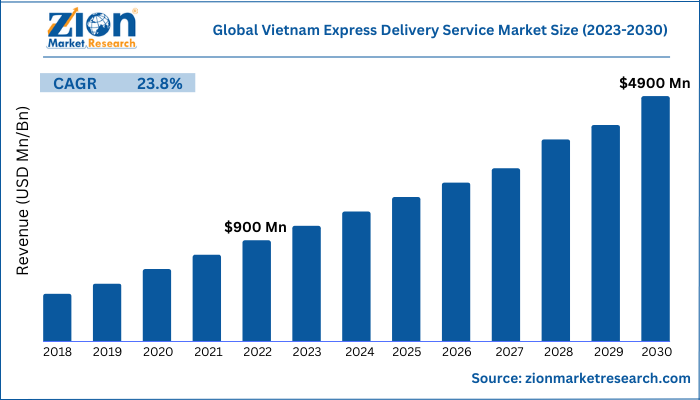

Vietnam express delivery service market size was worth around USD 1.36 Billion in 2024 and is predicted to grow to around USD 10.65 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 22.86% between 2025 and 2034. The report analyzes the global vietnam express delivery service market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the vietnam express delivery service industry.

In this report, we will cover the full overview, growth drivers, opportunities, and obstacles of the Vietnam express delivery service market from 2023 to 2030.

Vietnam Express Delivery Service Market: Overview

Express Delivery is the best shipping platform that delivers various goods and products through mediums such as air, water, and land. Some extra money for shipping would be extracted from the intended customer and the products will reach him within the time span of 24 to 72 hours depending on his location.

Express shipping is slightly expensive compared with other forms of transportation systems. However, they are very reliable and safe when it comes to preserving and delivering your product in time. They operate on a B2B (business-to-business) model, B2C (business-to-customer) mode, or C2C (customer-to-customer) mode as well. The products or goods transportable include anything from letters to documents or any consumer goods and non-palletized goods. It is not only mere delivery, they also have other arbitrary services such as packaging, labeling, billing, return, and exchange.

They are also widely leveraged by brands and E-commerce forums for delivering goods to customers in optimal time. Customers also place orders for food products or sometimes jewelry and would not mind spending money for proper safe delivery.

Key Insights

- As per the analysis shared by our research analyst, the global vietnam express delivery service market is estimated to grow annually at a CAGR of around 22.86% over the forecast period (2025-2034).

- Regarding revenue, the global vietnam express delivery service market size was valued at around USD 1.36 Billion in 2024 and is projected to reach USD 10.65 Billion by 2034.

- The vietnam express delivery service market is projected to grow at a significant rate due to growth booming e-commerce, rising cross-border trade, urbanization, increasing consumer demand for fast shipping, and infrastructure improvements.

- Based on Application, the B2B segment is expected to lead the global market.

- On the basis of End Use, the E-commerce Platform segment is growing at a high rate and will continue to dominate the global market.

- Based on the Destination, the Domestics segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Vietnam Express Delivery Service Market: Growth Drivers

Rising e-commerce industries along with growing reliance on B2C deliveries fuel market growth

The growth of e-commerce industries and rampant B2C deliveries in current times are expected to drive market growth. International trade services across the world have seen an improvement that will indirectly aid the market exclusively.

Pandemic has triggered an increase in the import and export of raw materials, consumer goods, and products which is also seen as a growth driver for the market. Food & beverages and healthcare fields have incorporated online delivery systems in recent times which has spiked the demand for these services. Healthcare especially has been leveraging these delivery services exquisitely to deliver significant samples and medicines on time to save lives. This high demand for quality, availability, accuracy, and cost control in the healthcare sector places high expectations on logistic solutions thereby triggering market growth.

Express delivery services are also extensively used by e-commerce platforms to offer a better customer experience by delivering parcels in less time. Apart from this, consumers rely on these services exclusively for receiving food products and luxury items like jewelry. These different leverage applications of express delivery services by the consumers work as effective growth drivers of Vietnam express delivery service market.

Vietnam Express Delivery Service Market: Restraints

Higher operation costs along with lack of infrastructure are restraints for market growth

The lack of infrastructure and innovations in the delivery service platforms hinders market growth to some extent. Apart from this, the operational cost of delivery service and logistic expenses is on the higher side impacting the affordability of the consumers. This factor also hinders the market growth considerably.

Vietnam Express Delivery Service Market: Opportunities

Emerging technological advancements and recent possibility of last-mile deliveries are opportunities for the market.

The rise in technological advancements and the effect of last-mile deliveries with the help of advanced vehicles offer lucrative opportunities to the market. Value-added delivery services, when coupled with the introduction of the faster delivery system, are also factors supporting the market prospectively in the future. Adoption of smartphones and improving internet access have influenced many businesses to incorporate online delivery channels providing opportunities for expansion of the market.

Vietnam Express Delivery Service Market: Challenges

Increasing demand for express delivery service industry due to prevalence of pandemic poses a challenge for the market

The outbreak of Covid-19 made people shop from home thereby heavily relying on delivery services to transport essential goods. This has increased the demand for express delivery services depending on effective infrastructures and efficient transport systems to meet the expectations of the consumers. This need for improvement in transport mediums and infrastructure to satisfy this massive demand poses a challenge for the express delivery service market.

Higher cost of delivery services combined with expense of total logistics pose a challenge for the market

Weak transport infrastructures and a lack of faster vehicles have inflated the prices of service delivery. This reduces the affordability of delivery services thereby bringing down its overall leverage. This is a potential challenge to the growth of the market.

Vietnam Express Delivery Service Market: Segmentation

Vietnam express delivery service market in this research analysis is classified by destination, business type, end-user, and region.

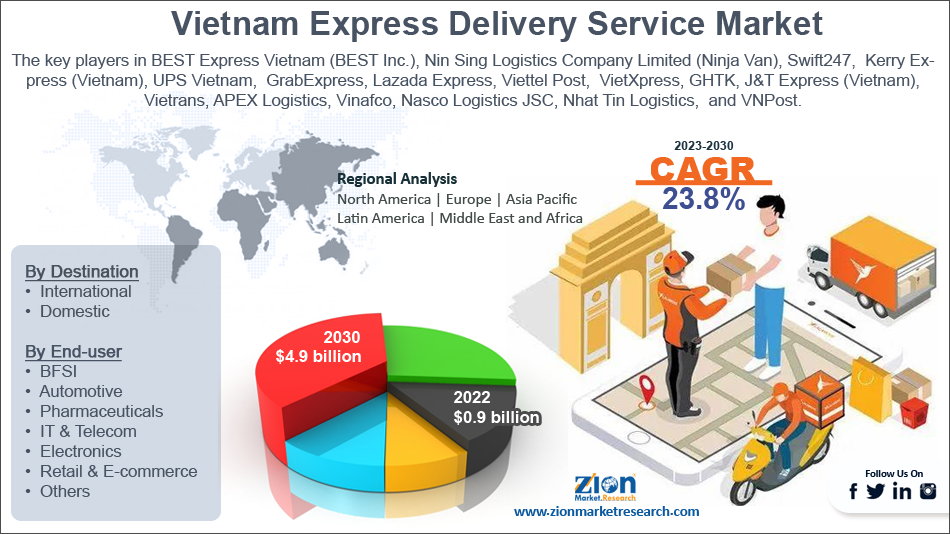

The end-user comprises BFSI, automotive, pharmaceuticals, IT & telecom, electronics, retail & e-commerce, and others.

Based on destination, the market is bifurcated into domestic and international. The domestic segment held the largest market share in 2022 and is further predicted to grow rapidly at a notable CAGR during the forecast period. The major reason for the growth of this segment is the ease of transportation and availability of favorable initiatives from the government to promote express delivery services within the country. In addition, domestic express delivery is very convenient and cost-effective for customers and also fairly more profitable and less tedious than international express deliveries. International express delivery services are typically more complex and require specialized knowledge and infrastructure to handle customs clearance and other international regulations. These factors are expected to drive the growth of the segment during the forecast period.

Based on business type, the market is segmented into B2B and B2C segments. The B2C segment is expected to grow at the fastest CAGR during the forecast period. The growth of this segment is mainly due to the increase in the popularity of e-commerce among people. In addition, the availability of reliable internet services and an increase in the number of users along with the rapid adoption of smartphone devices among people drive the growth of the segment. Besides, this segment is expected to continue growing in the coming years, driven by the growth of online marketplaces and the increasing adoption of digital payment methods. While the volume of goods transported in B2C delivery may be smaller, the high volume of transactions can result in higher overall revenue for the service provider. These factors drive the growth of the segment.

Recent Development

- In May 2021, DHL International GmbH launched cutting-edge equipment, DHL smart sensors, and an automated container unloading system to avoid misplacement of parcels and easy transportation.

- In December 2021, VNPost, Vietnam's largest postal operator, launched a new express delivery service called "eParcel Express" aimed at meeting the growing demand for e-commerce deliveries. The service offers same-day and next-day delivery options for both domestic and international shipments.

- In November 2021, GrabExpress, an on-demand delivery service arm of ride-hailing giant Grab that has live GPS tracking, expanded its express delivery services to cover more areas in Vietnam. The company now offers on-demand delivery services in over 200 cities and provinces in Vietnam, including remote and rural areas.

- In October 2021, Giao Hang Tiet Kiem, a dominant Vietnamese logistics and delivery company, secured a $100 million investment from a consortium of investors, including Warburg Pincus, Temasek Holdings, and SoftBank Vision Fund 2. The funding will be used to expand the company's logistics network and enhance its technology platform.

Vietnam Express Delivery Service Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Vietnam Express Delivery Service Market |

| Market Size in 2024 | USD 1.36 Billion |

| Market Forecast in 2034 | USD 10.65 Billion |

| Growth Rate | CAGR of 22.86% |

| Number of Pages | 221 |

| Key Companies Covered | GHN (Fast Delivery), BEST Express Vietnam (BEST Inc.), GHTK, J&T Express (Vietnam), Kerry Express (Vietnam), Nasco Logistics JSC, Nhat Tin Logistics, Nin Sing Logistics Company Limited (Ninja Van), Swift247, Viettel Post, VNPost, and others. |

| Segments Covered | By Application, By End Use, By Destination, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Vietnam Express Delivery Service Market: Regional Landscape:

Vietnam contributes to the market growth of express delivery by being the largest consumer

The increase in the value-added services in express delivery contributes to market growth in Vietnam. There are distinct types of services that are becoming prominent in the region which fuels market growth here. Grading, the assortment of products, labeling, packaging, and security tagging are some of the extra services that are gaining traction in this region. Rapid focus on vendors who are keen to provide value-based services is also expected to drive the growth of Vietnam express delivery services market promptly.

Vietnam Express Delivery Service Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the vietnam express delivery service market on a global and regional basis.

The global vietnam express delivery service market is dominated by players like:

- GHN (Fast Delivery)

- BEST Express Vietnam (BEST Inc.)

- GHTK

- J&T Express (Vietnam)

- Kerry Express (Vietnam)

- Nasco Logistics JSC

- Nhat Tin Logistics

- Nin Sing Logistics Company Limited (Ninja Van)

- Swift247

- Viettel Post

- VNPost

The global vietnam express delivery service market is segmented as follows;

By Application

- B2B

- B2C

By End Use

- E-commerce Platform

- Social Media Platform

- Document Service

- Others

By Destination

- Domestics

- International

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Express Delivery is the best shipping platform that delivers various goods and products through mediums such as air, water, and land. Some extra money for shipping would be extracted from the intended customer and the products will reach him within the time span of 24 to 72 hours depending on his location. Express shipping is slightly expensive compared with other forms of transportation systems. However, they are very reliable and safe when it comes to preserving and delivering your product in time. They operate on a B2B (business-to-business) model, B2C (business-to-customer) mode, or C2C (customer-to-customer) mode as well.

The global vietnam express delivery service market is expected to grow due to increasing urbanization and rising consumer demand for faster deliveries, and continuous investment in logistics infrastructure and technological advancements like automation and AI for improved efficiency.

According to a study, the global vietnam express delivery service market size was worth around USD 1.36 Billion in 2024 and is expected to reach USD 10.65 Billion by 2034.

The global vietnam express delivery service market is expected to grow at a CAGR of 22.86% during the forecast period.

Asia-Pacific is expected to dominate the vietnam express delivery service market over the forecast period.

Leading players in the global vietnam express delivery service market include GHN (Fast Delivery), BEST Express Vietnam (BEST Inc.), GHTK, J&T Express (Vietnam), Kerry Express (Vietnam), Nasco Logistics JSC, Nhat Tin Logistics, Nin Sing Logistics Company Limited (Ninja Van), Swift247, Viettel Post, VNPost, among others.

The report explores crucial aspects of the vietnam express delivery service market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed